Capital markets, COVID-19, and policy measures

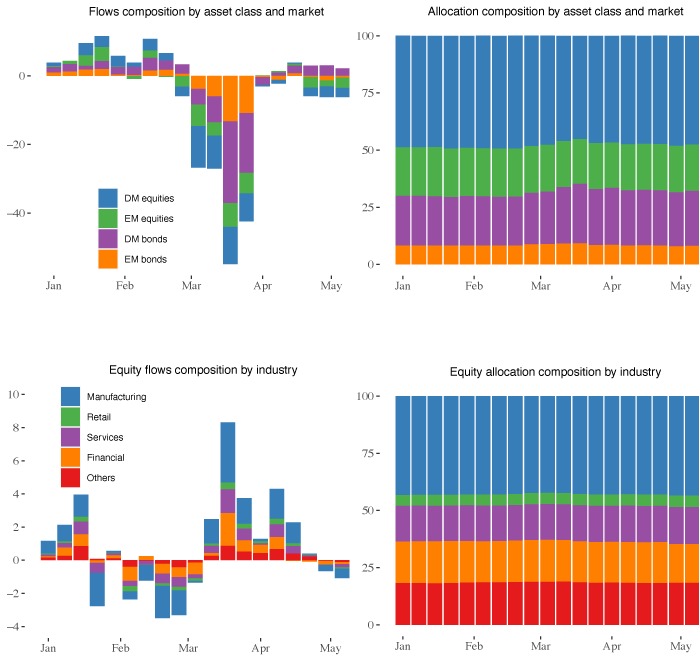

Compounding the world-wide recession induced by the COVID-19 pandemic, the around the world wellbeing crisis also spurred a dramatic response in funds marketplaces (Alfaro et al. 2020, De Bock et al. 2020). As traders gauged the economic consequences of the pandemic and the subsequent policy responses, they initiated a wave of capital reallocation among marketplaces, asset classes, and industries. Figure 1 illustrates that this world shift in worldwide portfolio flows was of historically significant magnitude and that countries’ practical experience at the top of the episode differed greatly. Figure 2 depicts the reallocation throughout markets, asset classes, and industries.

Figure 1 Densities of portfolio flows (% of allocation)

Figure 2 Composition of net portfolio flows (US$ billion) and allocation (% of full) across time, 2020

Notes: DM and EM stand for made marketplace and rising market, respectively.

The heterogeneity throughout countries indicates that domestic pull aspects have performed an crucial function, standing in distinction to previously hazard-off activities these as the world-wide financial disaster and the taper tantrum. During these earlier occasions, the effect on portfolio flows was less dispersed throughout countries and largely identified by global drive variables (among the other people Fratzscher 2012, Rey 2015, Avdjiev 2020). The problem then occurs as to regardless of whether personal countries’ managing of the crisis contributed to shaping the differing dynamics of portfolio flows.

In a the latest paper (ElFayoumi and Hengge 2020), we use significant-frequency knowledge to deal with this issue by evaluating global money markets’ response to countries’ success, or deficiency thereof, in containing the pandemic and the critical coverage measures that governments enacted to restrict the toll on general public wellbeing and the economic system. Additional specially, we look at if and how the range of domestic infections, the stringency of the lockdown, and the fiscal and financial policy reaction determined the magnitude of portfolio flows, market-implied sovereign chance, and inventory charges all through the COVID-19 pandemic.1 In addition, we check out four sources of heterogeneity based mostly on marketplace development (emerging vs. produced), asset class (bonds vs. equities), investors’ domicile (international vs. domestic), and industries.

The influence of infections and policy responses on funds marketplaces

We build a panel dataset for 38 rising and designed marketplaces, with weekly information on the selection of new COVID cases, the stringency of governments’ lockdown, and the fiscal and financial coverage response. We match these details with weekly portfolio flows from EPFR, spreads of sovereign credit rating default swaps (CDS), and stock rates. Our empirical solution depends on regional projections (Jordà 2005) to estimate both of those the contemporaneous and the dynamic response above a one particular-month horizon.

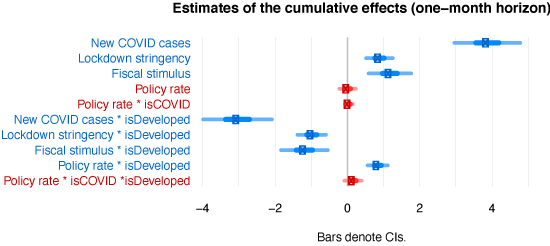

We obtain that the domestic unfold of the virus led to a cumulative enhance in total web portfolio flows2 in emerging marketplaces. This maximize was involved with a reallocation toward safer property as equity holdings declined and bond flows rose. Sovereign CDS spreads amplified, suggesting that the improve in net portfolio flows was driven by demand for liquidity, probably reflecting widening financing desires to mitigate the fallout from the pandemic (Determine 3).3

Our evaluation also exhibits that, next an preliminary adverse reaction, a additional stringent lockdown led to larger internet portfolio flows above the 1-thirty day period horizon in emerging marketplaces. Similarly, governments’ attempts to supply fiscal stimulus were prosperous in supporting higher portfolio flows to the domestic economic system. As opposed to the scenario for COVID infections, our outcomes suggest that larger sized internet portfolio flows in reaction to lockdown and fiscal stimulus actions ended up pushed by an enhanced offer of financing, amidst more powerful global desire for investment in safer asset lessons. We do not obtain evidence that financial plan actions in rising marketplaces performed a job in the dynamics of portfolio flows. We interpret this locating in light-weight of the dilemma speculation (Rey 2015), whereby US economical dominance renders emerging marketplace financial plan ineffective towards sector fluctuations.

Figure 3 Affect of domestic COVID scenarios and plan reaction on full internet portfolio flows

In developed markets, the selection of bacterial infections, the lockdown stringency, and fiscal stimulus do not show up to have played a job in driving web portfolio flows above a just one-month horizon. Monetary coverage loosening, in distinction, led to a decrease in net portfolio flows – each for bonds and equities – as anticipated by interest fee parity. Interestingly, a reduction in rates induced an raise in web flows on impact, suggesting that financial plan actions were profitable in providing original reassurance to marketplaces.

Domestic-domiciled portfolio flows

The conclusions presented previously mentioned aim on foreign-domiciled flows, that is, flows stemming from money which are domiciled exterior the recipient state. Although overseas buyers are likely to be more diversified, domestic investors’ stability sheets are much more susceptible to countries’ idiosyncratic shocks thanks to their usually increased publicity to the regional economic climate. This exposure provides an supplemental dimension to their response to domestic shocks, when when compared to that of overseas traders (Caballero and Simsek 2020). Furthermore, as Maggiori et al. (2020) stage out, domestic investors are far more likely to maintain belongings in nearby currency, which can amplify the effects of domestic fluctuations. In contrast, foreign investors allocate their resources in foreign-denominated belongings, which present them much better insulation from neighborhood shocks and exchange amount fluctuations. We obtain proof that domestic and international investors without a doubt responded otherwise to the spread of the pandemic, whereby domestic-domiciled complete internet portfolio flows declined in reaction to an raise in COVID scenarios, ensuing in a bigger share of foreign flows relative to domestic flows.

Effects of the lockdown across industries

The COVID-necessitated lockdown measures had a different impression on economic action across various industries, provided their heterogeneous exposures to the relevant demand from customers and supply factors, these kinds of as irrespective of whether a product or provider is regarded as crucial and the extent to which the market is reliant on global offer chains. Against our prior expectation, we come across that the result of lockdown measures on the retail sector was not specially diverse from the fiscal and solutions sectors. All a few sectors witnessed reduce web portfolio flows in reaction to a additional stringent lockdown, compared to the benchmark group.4 Net flows in the producing sector, in contrast, enhanced strongly as the lockdown grew to become stricter.

The part of coverage actions for the worldwide shock

In addition to their direct result, domestic policy measures can also impression the dynamics of portfolio flows by mitigating or exacerbating the impression of the world wide shock. To quantify the relevance of this channel, we estimate the effect of the interaction between the VIX – as a steady measure of the world shock – and the lagged coverage response. Our results reveal that fiscal and monetary plan stimulus played an vital role in attenuating the detrimental impression of the world shock the two in rising and developed marketplaces. In distinction, more stringent lockdown policies may perhaps have amplified the destructive effect of the world shock, particularly in developed economies.

Authors’ note: The views expressed are all those of the authors and do not automatically represent the sights of the IMF, its Government Board, or IMF management.

References

Alfaro, L, A Chari, A Greenland and P K Scott (2020), “Aggregate and business-amount stock returns during pandemics, in serious time”, in Covid Economics 4: 2-24.

Avdjiev, S, L Gambacorta, L S Goldberg and S Schiaffi (2020), “The shifting motorists of worldwide liquidity”, Journal of Worldwide Economics 125: 103324.

Caballero, R J and A Simsek (2020), “A Design of Fickle Capital Flows and Retrenchment”, Journal of Political Financial system 128(6): 2288-2328.

De Bock, R, D Drakopoulos, R Goel, L Gornicka, E Papageorgiou, P Schneider and C Sever (2020), “Managing unstable funds flows in emerging and frontier markets”, VoxEU.org, 19 August.

ElFayoumi, K and M Hengge (2020), “Capital Markets, COVID-19 and Plan Steps”, in Covid Economics 45: 32-64.

Fratzcher, M (2012), “Capital flows, force as opposed to pull variables and the world-wide economic crisis”, Journal of Global Economics 88(2): 341-356.

Gilchrist, S and E Zakrajšek (2012), “Credit spreads and enterprise cycle fluctuations”, American Economic Assessment 102(4): 1692-1720.

Jordà, Ò (2005), “Estimation and inference of impulse responses by nearby projections”, American Economic Evaluation 95(1): 161-182.

Maggiori, M, B Neiman and J Schreger (2020), “International Currencies and Funds Allocation”, Journal of Political Economic climate 128(6): 2019-2066.

Rey, H (2015), “Dilemma not trilemma: the world-wide economic cycle and financial plan independence”, National Bureau of Economic Analysis.

Endnotes

1 The analysis focuses on the domestic component of these variables, even though managing for world-wide variables.

2 Overall internet portfolio flows are outlined as the web worth of buys and redemptions of bond and fairness resources.

3 Merged, information and facts about the quantity (flows) and cost (CDS spreads and inventory prices) of property delivers an identification of the offer and need channels of portfolio flows. To the extent that these two actions are tightly connected by marketplace forces, shifts in offer are affiliated with alterations in flows and spreads in opposite directions, whilst shifts in need go both of those variables in the similar direction. This intuition is in line with Gilchrist and Zakrajšek (2012) who examine the relative contribution of credit offer and desire aspects in corporate bonds.

4 The benchmark is the group of industries categorized into the sector “Others”.