Fresh Market Stock: Pandemic, Inflation And Higher Rates (TFM)

AJ_Watt/E+ by using Getty Photos

The next segment was excerpted from this fund letter.

Fresh new Industry (TFM)

Clean Industry is a chain of 159 mid-sized, fresh meals-concentrated grocery retailers, with perishables building up 71% of sales (compared to 35% in conventional grocery outlets). Its qualified shopper is related to that of Total Meals, owned by Amazon (AMZN). Clean Industry specially benefitted from the sharp boost in in-property eating triggered by the pandemic. While purchaser targeted traffic declined by 10% as customers restricted trips outside the house the dwelling, common transaction dimension improved 25% and exact same-keep profits rose 22%. As a result, EBITDA nearly doubled year-in excess of-year, and the corporation reduced leverage from 6.7x at the end of fiscal 2020 to 3.3x at the close of the fiscal 12 months finished January 2021. Targeted on the sharply improved working performance and a far better credit rating profile, we started paying for the 9.75% Secured Observe, due May well 1, 2023 in the initial fifty percent of 2021. The purchases designed in the course of the year had yields-to- maturity in surplus of 7.70%.

Affect of Re-Opening and Inflation

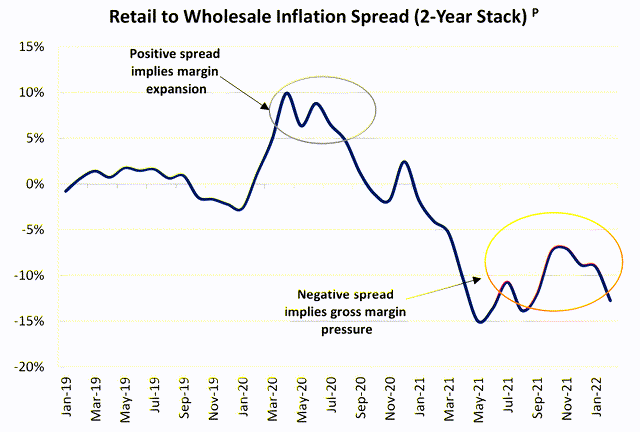

In the two yrs ended February 2022, the consumer rate index for meals at household has risen 12.5% led by meat/poultry/fish/eggs at 18.9% and fruits & greens at 11.3%, groups which Refreshing Sector emphasizes. As demonstrated over, the difference involving retail and wholesale inflation turned destructive in 1Q21, implying shrinking margins for grocers. Therefore, with the current sharp increase in gasoline charges, coupled with food items inflation, grocers confront the opportunity for reduced margins and the hazard that people shift food paying towards lessen cost choices.

In 2021, Refreshing Market’s advancement slowed from the torrid rate of calendar 12 months 2020, significantly throughout the summer time and fall as the pandemic eased and men and women were being eager to get out of their residences. As a end result, for the 9 months finished October 2021, Clean Market’s transaction rely enhanced by 9.3%, reflecting larger consumer convenience in going to stores, but very same-retail store income growth slowed to 3.2%, nevertheless stable, and normal transaction measurement declined 5.6% as buyers felt much less have to have to fill their pantries. Directionally mirroring the graph above, EBITDA margin fell from 11.6%, in the very first a few quarters of 2020, to 9.9% in the equivalent period of time in 2021. As a final result, web leverage rose from 3.3x to 3.7x all through the to start with three quarters of 2021. That said, even if EBITDA ended up to tumble by 25% in 2022, web leverage would only rise to 5.0x, continue to healthy for a grocery keep credit. As Refreshing Sector targets a buyer who tends to emphasis on refreshing food items and much healthier alternate options, it is probable to be less impacted by rising charges. Additionally, when commodity foods selling prices may possibly practical experience sharp spikes in reaction to adverse gatherings, these have tested to be transitory with consumer food items selling prices determined a lot more by surplus or deficit pushed by seasonal harvests, extremely dependent on weather conditions, and cost of non-foodstuff parts these kinds of as internet marketing, packaging and transportation.

Effects of Increased Desire Rates

Refreshing Market place is concentrated on reduction of leverage, owning recently repaid $90 million of a senior priority notice with funds produced from functions, leaving $43 million excellent. The bond we individual matures on May 1, 2023 as a result, Clean Sector need to come across a way to repay the bond by that date or face default. We feel the enterprise has quite a few avenues to effect compensation of the bond. In July 2021, Clean Marketplace filed an S-1 Registration Statement for an IPO, which was current on March 14, 2022. The IPO has been deferred hence much due to current market conditions, but, if the environment increases, IPO proceeds would probably be utilised to repay the bond. The firm could also go after a debt funding, issuing either a new secured bond or a mix of bonds and phrase bank loan that would present prepayment flexibility. Refreshing Market place is presently rated B3/B- (Moody’s/S&P). We estimate that the credit history spread for a B3/B- bond would be about 540 foundation points whilst CCC bonds would have a distribute of about 750 foundation factors. Thus, a new 5-yr bond would probably be issued at a produce among 8.00% and 10.00%. This would continue to final result in desire cost equivalent to or decrease than the organization is at present spending on its 9.75% bond. Were the enterprise to elect to split the funds elevate concerning a new bond and a expression bank loan, the whole fascination cost could be a bit decrease. In addition, the company’s personal equity sponsor, Apollo, a short while ago offered capital to enable it to repay its revolving credit facility. Thus, it is reasonable to consider that Apollo would step up to secure its equity place

ment. Lastly, the firm would be an beautiful strategic acquisition for a competitor. All-in, we feel that the price of the enterprise exceeds the credit card debt by the bonds we maintain.

Bond Pricing and Present-day Watch

During 1Q22, the rate of the New Marketplace bond declined from somewhere around 103 to 98.25, resulting in an maximize in its produce-to-maturity from 7.34% to 11.49%. We attribute most of the decline to large yield cash “taking some chips off the table” by offering a shorter maturity bond to satisfy outflows. Getting benefit of this price tag decline, we added to the placement in the course of the quarter.

Editor’s Observe: The summary bullets for this write-up have been picked by Looking for Alpha editors.