New Mexico reduces title insurance premiums

Starting July 1, New Mexicans who purchase, market, or finance a home will pay out significantly less for title insurance plan. Title insurance is a sort of insurance coverage that shields loan companies and homebuyers from economic reduction because of to defects in a title to a property. Many thanks to the efforts of Assume New Mexico, premiums for title insurance policy guidelines will decrease by 6. per cent. Assume New Mexico is a results-oriented believe tank whose mission is to strengthen the lives of all New Mexicans, in accordance to their internet site at https://www.thinknewmexico.org/. They have been advocating for New Mexico people given that 1999.

Consider New Mexico submitted comments in the course of the most latest ratemaking process highlighting how promptly mounting home selling prices have improved title insurance policies fees for individuals, according to their press launch. Which is for the reason that the value of title insurance coverage is established by the benefit of the property or quantity financed. The bigger the profits rate or mortgage amount of money, the increased the high quality. In the past yr by itself, higher values amplified the cost of title insurance coverage by 13 per cent. The reduction is slated to save New Mexicans all over the state hundreds of dollars in premium prices heading ahead.

So, what is title insurance? In contrast to “regular” insurance policy that anticipates some future celebration, this sort of as an auto accident or illness, title insurance coverage insures earlier gatherings, these types of as the transfer of titles to houses. The worst-scenario nightmare is when an individual knocks on the doorway of the home you just acquired and tells you that your deed is a forgery and that they’re the precise entrepreneurs of the property. Title insurance shields your interest should a thing like that at any time come about.

Additional from Gary:How accurate is the assessed worth of your household?

Domestically, an excellent illustration of the genesis of a “chain of title” began with the signing of the Gadsden Acquire in 1853. The purchase of land from Mexico by the U.S. was made to resolve a boundary dispute that resulted at the termination of the Mexican American War.

It was at that time that the 29,670 sq. miles of Mexican land that was the matter of the treaty grew to become portion of the United States. In essence, the treaty produced a brand-new parcel of U.S. land covering pieces of Southern New Mexico and Southern Arizona. More than time the land was divided and marketed, re-divided and willed, subdivided, forfeited and, in some situations, gifted to relatives associates. Even though large sections of desert continue to belong to the Federal Federal government, significant swaths have been subdivided many times and are now getting bought as unique house loads.

So, who ensures that the chain of title to the assets you are buying is unbroken and that all of the proprietors who came just before you – all the way back again to the Gadsden Acquire – definitely had the right to pass the property title along to the upcoming owner? That obligation falls on the shoulders of the title insurance coverage enterprise. Title providers can ensure that a title is “clear” because they look for the general public documents to make absolutely sure that it is. The method is really easy.

When a title enterprise initiates a title look for, they check out for liens, judgments, and other legal filings posted versus the purchaser, the seller, and the home currently being sold. The title searcher (yep, which is his or her title) searches both the court data and the general public documents of the county recorder’s place of work in which the house is positioned. At the summary of the search, the title corporation will concern a title determination outlining any prerequisites the parties have to fulfill in buy for the company to assure a cleanse transfer of title.

Requirements can assortment from the simple execution and recording of a launch of an aged paid out-off home finance loan to the disposition of authorized matters that can only be settled in court. After all of the ailments have been fulfilled, the title organization is well prepared to challenge a Policy of Title Insurance plan.

Far more in genuine estate:Now’s the time to protest assets values and utilize for exemptions

What does the title coverage coverage include? The American Land Title Affiliation estimates that 20-five percent of title lookups obtain a title challenge that is preset ahead of the insurance is issued. Occasionally and in spite of an exhaustive title search, hidden hazards can emerge after closing. Issues such as faults in the public report, previously undisclosed heirs declaring to very own the property, solid deeds and unrecorded easements could all cloud the title. If any of these or other related challenges had been to occur, the owner’s title insurance plan presents fiscal protection towards them by negotiating with third parties and paying out the authorized statements and fees included in defending the title.

What does title coverage cost? At the moment, the level for a lender coverage on a $272,500 bank loan is $1,373. The upcoming 6% reduction will help save a borrower financing that sum in the vicinity of $82.00. Multiply that range by the thousands of transactions shut in the point out every calendar year and one can see how the savings can speedily include up.

Though the price of the insurance may possibly nonetheless seem high, the danger of buying with no it could be noticeably increased.

See you at closing!

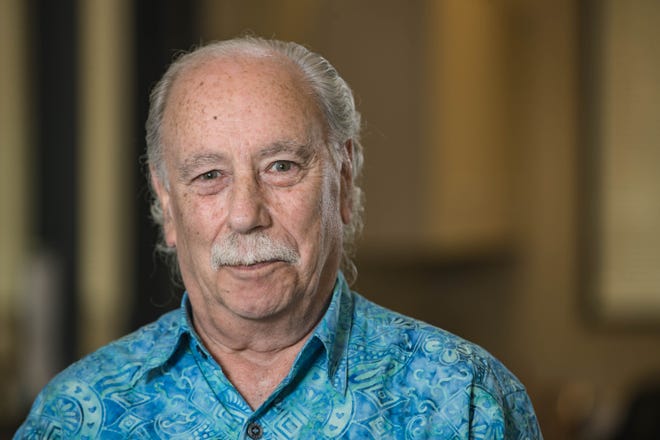

Gary Sandler is a total-time Real estate agent and president of Gary Sandler Inc., Realtors in Las Cruces. He loves to reply thoughts and can be attained at 575-642-2292 or [email protected].

Many others are studying: