Ovintiv Pursuing Natural Gas Price ‘Diversification,’ Citing Strong Market Fundamentals

Ovintiv Inc. is checking out options to improve the publicity of its multi-basin upstream portfolio to a dynamic world-wide organic fuel industry, CEO Brendan McCracken stated.

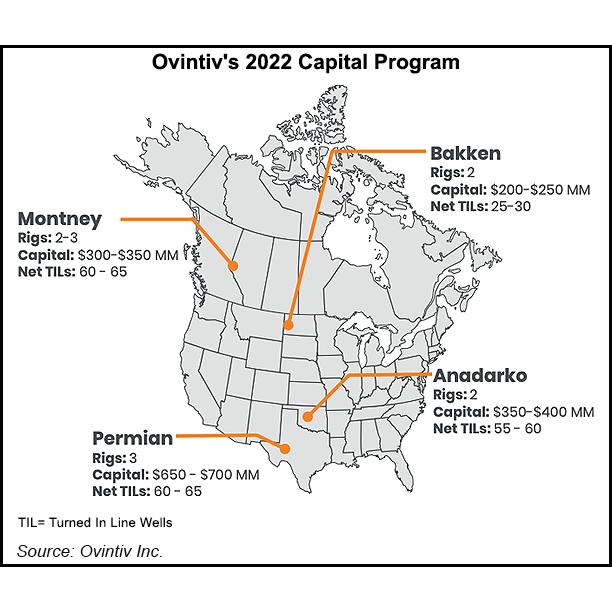

The Denver-based impartial performs in a lot of onshore plays through North The us, which includes in the Montney Shale, Anadarko Basin, Permian Basin, Bakken Shale and Uinta Basin.

On a phone to focus on to start with-quarter earnings, McCracken highlighted Ovintiv’s “huge stock of superior-return fuel,” and reported the administration group is “quite encouraged by the long-expression fuel fundamentals.”

He cited Ovintiv’s strategy of normal gasoline price tag diversification, detailing that about 80% of the firm’s Permian generation is priced outdoors of the Waha hub and about 50% of its Canadian output is priced outdoors the NOVA/AECO hub.

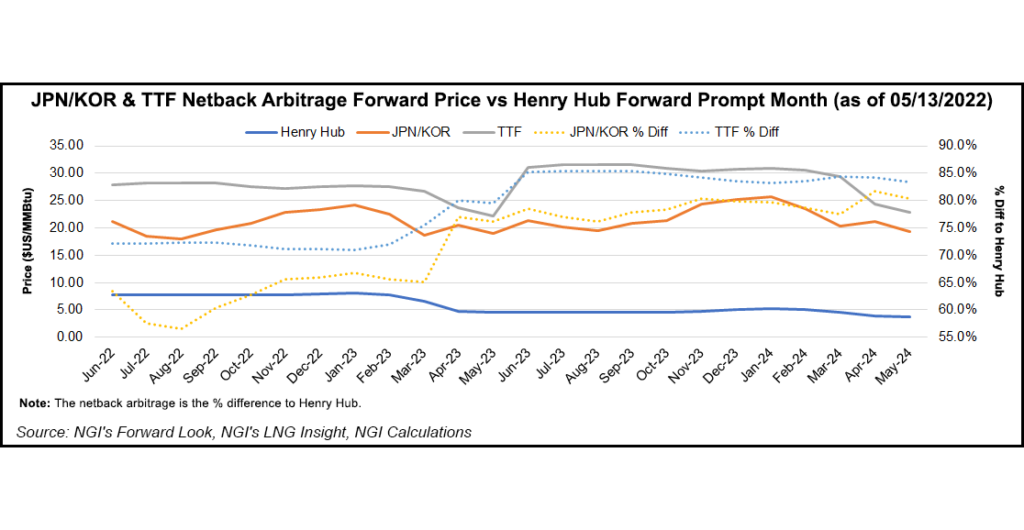

He added that as element of this tactic, Ovintiv is “considering alternatives for finding that pricing exposure” to the white-warm world wide liquefied all-natural fuel (LNG) market. International LNG benchmarks, particularly Europe’s Title Transfer Facility and Asia’s Japan Korea Marker, have traded at a sizeable high quality to the U.S. benchmark Henry Hub amid intense opposition for molecules.

Ovintiv is not pursuing equity pursuits in LNG jobs, McCracken stated, but it is “certainly searching at some of the evolving industrial opportunities…that could be on the West Coast of Canada or off the U.S. Gulf Coastline or a mix of both equally, and so that is something we’re actively seeking at nowadays.”

Equipment, Crews in Small Supply

Ovintiv has upwardly revised its 2022 capital paying price range in buy to keep the very best rigs and personnel throughout its multi-basin portfolio, according to its executives.

Producers and oilfield products and services firms alike have cited a scarcity of prime-notch “super-spec” drilling rigs and experienced hydraulic fracturing crews this yr amid a restricted international oil current market.

Ovintiv’s management team highlighted effectiveness gains obtained by drilling lengthier lateral footage for each properly, and by increased usage of the simultaneous fracturing, aka simul-frac, completions system.

COO Greg Givens mentioned “we are incorporating a modest amount of capital to this year’s strategy exclusively devoted to holding our superior spec machines and simul-frac spreads jogging through the finish of the 12 months and into 2023. Functioning a lot quicker and extra competently has by no means been much more critical.

“Therefore, in order…to maintain our field-leading operational edge, we are using a proactive tactic to retain the large top quality gear and crews essential to produce our main efficiencies.”

McCracken claimed Ovintiv will not search for to enhance generation this calendar year, notwithstanding the bullish outlook for oil and organic gasoline pricing.

“Despite the considerable inflationary pressures impacting our business, we continue on to supply top tier funds efficiency and crank out remarkable returns,” McCracken explained. “We are protecting willpower in a risky current market and will not spend in expansion in 2022.”

The CEO noted that, “Towards the finish of Q1 and into Q2, we have seen inflation step up earlier our primary expectations. This incremental inflation has been mainly driven by larger commodity prices, world-wide geopolitical activities, and offer chain disruptions.”

Multi-Basin Approach

Ovintiv generated about 500,000 boe/d in the 1st quarter, together with 173,000 b/d oil, 79,000 b/d purely natural gasoline liquids (NGL) and 1.49 Bcf/d natural gasoline.

“Production in the quarter was impacted by increased Canadian royalty charges, operational delays and climate disruptions,” management stated. McCracken pointed out that royalty prices in Canada are straight linked to commodity price ranges, which have soared this year.

The enterprise generated 114,000 boe/d (79% liquids) in the Permian, 120,000 boe/d (61% liquids) in the Anadarko and 213,000 boe/d in the Montney (23% liquids).

Ovintiv turned 18 net wells to income just about every in the Permian and Anadarko, and 19 in the Montney.

To start with quarter wells turned to revenue in the Permian averaged a lateral length of in excess of 14,300 feet, or 30% more time than the 2021 software typical, administration claimed.

In the Anadarko, Ovintiv accomplished four wells with an average lateral size larger than 15,000 feet.

Ordinary recognized costs such as hedging losses ended up $82.08/bbl for oil and condensate, $34.94/bbl for NGLs and $2.60/Mcf for all-natural gasoline.

Why is Ovintiv Boosting Capex?

Ovintiv has upped its total-yr 2022 money expenditure forecast to a variety of $1.7-1.8 billion from previous assistance of $1.5 billion.

“The maximize in money is principally because of to incremental inflationary charge pressures supplied the increased commodity price tag natural environment,” administration claimed.

The upward revision also demonstrates “costs affiliated with keeping superior spec tools and chosen crews through yr-end,” the organization said.

Ovintiv strategies to invest $650-700 million in the Permian, $350-400 million in the Anadarko, $300-350 million in the Montney and $200-250 million in the Bakken during 2022.

“Planned action levels for the remainder of the year are mostly unchanged in comparison to the authentic steering,” administration explained, including, “Capital expenditure is anticipated to be 55 to 60% weighted to the 1st 50 % of the 12 months.”

Ovintiv stated it expects to produce complete-yr generation volumes of 180,000-185,000 b/d oil and condensate, 78,000-82,000 b/d NGLs and 1.45-1.5 Bcf/d purely natural gas.

Together with its 1Q2022 earnings, Ovintiv released its 2022 sustainability report, which highlighted reductions in greenhouse fuel (GHG) emissions and normal fuel flaring in 2021.

Ovintiv said it reduced its Scope 1 and 2 greenhouse gasoline emissions intensity by 24% in 2021 from 2019 ranges.

The company hit its concentrate on of reducing methane emission depth by 33% from 2019 stages four yrs ahead of routine, and diminished flaring and venting intensity to .4% of gross manufactured fuel in 2021 vs . .7% in 2020.

Ovintiv reported a web loss of $241 million (minus 94 cents/share) for the to start with quarter, versus a financial gain of $309 million ($1.19) in 1Q2021. The end result provided pre-tax hedging losses of $448 million.