Should You Buy Investors Title Company (NASDAQ:ITIC) For Its Upcoming Dividend?

Buyers Title Firm (NASDAQ:ITIC) is about to trade ex-dividend in the upcoming 2 times. The ex-dividend day is usually established to be 1 business enterprise day right before the history date which is the slash-off date on which you ought to be current on the firm’s textbooks as a shareholder in buy to acquire the dividend. The ex-dividend date is of consequence simply because anytime a inventory is acquired or bought, the trade normally takes at the very least two organization working day to settle. So, you can order Traders Title’s shares right before the 18th of March in buy to acquire the dividend, which the business will shell out on the 31st of March.

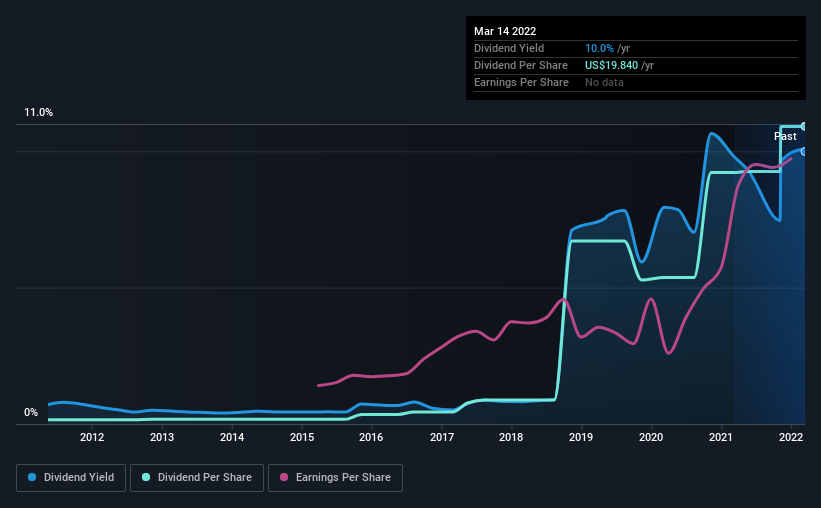

The firm’s upcoming dividend payment will be US$.46 for every share, and in the previous 12 months, the business paid a total of US$19.84 for each share. Calculating the final year’s truly worth of payments exhibits that Investors Title has a trailing produce of 10.% on the present share price tag of $198.5. We adore viewing corporations shell out a dividend, but it can be also critical to be positive that laying the golden eggs isn’t really heading to kill our golden goose! So we will need to look at irrespective of whether the dividend payments are lined, and if earnings are rising.

Test out our latest investigation for Traders Title

Dividends are generally paid out of business money, so if a firm pays out a lot more than it attained, its dividend is ordinarily at a better hazard of becoming slice. Buyers Title is shelling out out just 5.1% of its income immediately after tax, which is comfortably very low and leaves plenty of breathing space in the case of adverse events.

When a firm compensated out considerably less in dividends than it acquired in revenue, this frequently suggests its dividend is inexpensive. The reduce the % of its earnings that it pays out, the larger the margin of protection for the dividend if the company enters a downturn.

Click below to see how a great deal of its revenue Investors Title paid out out above the previous 12 months.

Have Earnings And Dividends Been Increasing?

Businesses with sturdy advancement potential clients usually make the best dividend payers, because it is easier to increase dividends when earnings for every share are increasing. Traders appreciate dividends, so if earnings tumble and the dividend is diminished, hope a stock to be sold off heavily at the same time. It is encouraging to see Traders Title has grown its earnings rapidly, up 28% a calendar year for the past 5 many years.

Yet another key way to measure a company’s dividend prospective clients is by measuring its historical fee of dividend progress. In the previous 10 yrs, Buyers Title has increased its dividend at close to 53% a year on typical. Both equally for each-share earnings and dividends have equally been increasing quickly in new instances, which is excellent to see.

The Base Line

Is Buyers Title an eye-catching dividend inventory, or better remaining on the shelf? When companies are growing promptly and retaining a the vast majority of the gains in just the business, it really is typically a sign that reinvesting earnings results in additional worth than shelling out dividends to shareholders. This technique can include important worth to shareholders around the extended phrase – as prolonged as it can be done with out issuing way too many new shares. All round, Traders Title appears like a promising dividend stock in this evaluation, and we think it would be worthy of investigating more.

So even though Buyers Title seems superior from a dividend point of view, it can be normally worthwhile being up to date with the risks concerned in this stock. In terms of expense threats, we’ve recognized 1 warning indicator with Buyers Title and comprehending them really should be part of your investment process.

Commonly, we would not advise just getting the initial dividend inventory you see. Here is a curated record of intriguing stocks that are robust dividend payers.

Have suggestions on this article? Worried about the material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This posting by Simply just Wall St is typical in character. We give commentary primarily based on historic data and analyst forecasts only applying an unbiased methodology and our posts are not meant to be economic assistance. It does not constitute a suggestion to buy or promote any stock, and does not acquire account of your targets, or your financial predicament. We aim to carry you extensive-term centered investigation driven by fundamental data. Take note that our investigation may perhaps not variable in the latest rate-sensitive organization announcements or qualitative product. Basically Wall St has no posture in any shares mentioned.