The Stock Market: Volatility To Continue

DNY59/iStock via Getty Images

I stand by the title of my inventory market place write-up very last week, “The Stock Market place: Going Into A Bigger Volatility Routine.”

The stock market place shut down for its fifth week in a row and volatility dominated current market exercise.

Inventory Efficiency for week of Could 2, 2022 (Wall Road Journal)

The S&P 500 Stock Index has had its really worth streak due to the fact June 2011, and the NASDAQ experienced its worst operate given that November 2021.

Kristina Hooper, the main world sector strategist at Invesco, is quoted in the Monetary Times

“There is an enormous volume of confusion in marketplaces.”

The Federal Reserve elevated its coverage array for the Federal Cash rate by 50 basis details to .75 percent to 1.00 %.

It also produced a short photograph of how it was likely to minimize the greenback price of securities in its portfolio of securities bought outright.

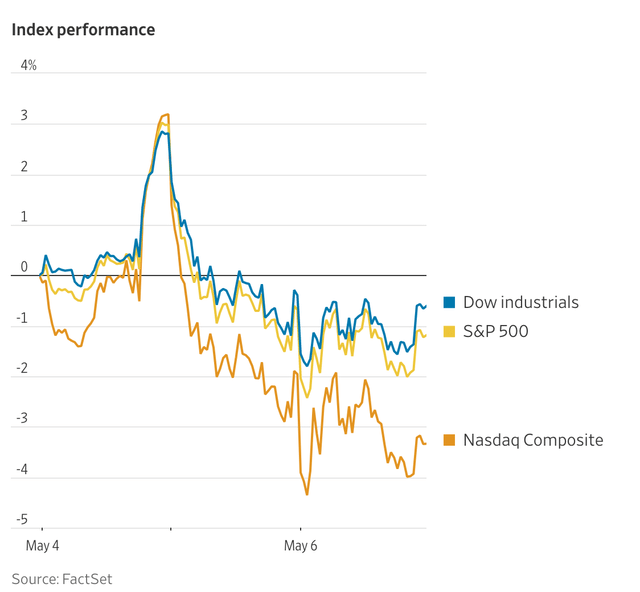

Wednesday, proper just after the announcement, stock prices rose significantly.

On Thursday the marketplaces turned all over and stock prices fell considerably.

Stock price ranges fell once more on Friday.

On Thursday, the Bank of England raised its fascination costs, when at the very same time forecasted that a “economic downturn was in the offing.” Not way too cheery of an outlook.

In addition, the generate on the 10-12 months U.S. Treasury bond closed higher than 3. % at the end of the week. Treasury yields have not been this superior for a very long time.

Two Issues

There are two factors that are, I consider, incredibly crucial in this picture.

Initial, there is inflation that would seem to be filling the United States.

Much more and much more, analysts are using the new improves in customer cost quantities as representing a significant shift in how the U.S. overall economy is doing. James Masserio, co-head of equities for the Americas at Societe Generale, has gone so far as to assert that there has been “a generational change in inflation.”

Inflation was extremely modest in the last period of economic enlargement, 2009 as a result of 2020. The compound, annual fee of customer selling price inflation all through this period was just less than 2.4 %.

For the twenty-five yrs before the Terrific Recession, which took place from December 2007 via June 2009, shopper price ranges enhanced only modestly from 12 months to calendar year

The developing sensation is that the new spherical of bigger rates of inflation is going to just take some time and hard work to unwind.

The 2nd point listed here fears the Federal Reserve.

It seems as if no just one seems to have any business experience of self-assurance in Fed Chairman Jerome Powell and his crew at the Fed.

The direct evidence of this is that Mr. Powell arrived out and declared this earlier Wednesday that the Federal Reserve was increasing its coverage rate of desire by 50 basis details.

And, the inventory marketplace went up!

The Regular & Poor’s 500 Stock Index rose by 125 factors!

This is not an insignificant rise.

Why did stock prices go up, when the Fed was making these kinds of a significant enhance in its plan rate of desire?

The current market turned all around on Thursday and Friday as Mr. Powell and many others at the Fed built ample sounds that they were truly heading to be severe about increasing the Federal Cash charge additional this calendar year, bringing the level up to all-around 3.00 per cent by the end of the calendar year and by shrinking the Fed’s balance sheet.

But, I am nevertheless not persuaded that Mr. Powell has the self confidence of traders when it arrives to seriously maintaining the Fed on monitor to fight inflation.

Mr. Powell has usually been noticed as a person who is intent upon erring on the facet of financial relieve so as to steer clear of any draw back challenges that may possibly happen.

In actuality, it is this belief that Mr. Powell errs on the facet of financial ease that has plagued Mr. Powell at each and every phase of his reign as Federal Reserve Chair.

“Analyst and investors available multiple theories for the share gyrations (by way of the latter element of the earlier week), nonetheless the key mood was just one of disorientation.”

This Is In which We Are

So, on to the future.

But, what about the future?

The future is, hugely unsure.

I have even referred to

the current point out we are in as one particular of radical uncertainty,

The essential issue is the Federal Reserve.

The Federal Reserve has gotten alone “overly active” in seeking to manipulate the economy.

Just one reads the analysis of the movements in the stock market this 7 days and a single continuously will come back to what the Fed has completed or what the Fed has not performed.

Of course, there are a ton of other issues happening in the world today, apart from inflation.

There are the gatherings using position in Ukraine. There is a soaring, as soon as once again, of pandemic scenarios. There are continue to source chain problems. China’s moves are not known. And, so on and so forth.

But, it appears to be as if practically all the things arrives back again to the Fed.

This is including in a significant way to the uncertainty that exists in the environment.

This should really not be.

Mr. Powell and the Fed have contributed drastically to the challenges that the Fed is now dealing with and it appears to be incredibly good at making even a lot more parts of uncertainty in all the things it gets concerned in.

The inventory industry is heading into a higher volatility regime. This is what traders are going to have to offer with.